What is GET or General Excise Tax Hawaii?

General Excise Tax is referred sales tax which is used to collect sales tax from buyers on the taxable goods and services.

The General Excise Tax license has the following significance:

-

General Excise Tax is imposed on gross business income, including any services or handling charges.

-

It is also used to collect excise tax on the non exempt purchases which are bought either from local or out of state vendors to use in the state of Hawaii.

What is the difference between sales tax and general excise tax?

Sales tax is charged to a customer whereas general excise tax is charged to a business and then a business applies sales tax to their customers on taxable items and services.

What is the state of Hawaii processing time to issue a General Excise Tax License?

Generally, the state of Hawaii issues General Excise Tax License same day unless there is a flaw in Hawaii Sales Tax Application and require additional information to complete the process.

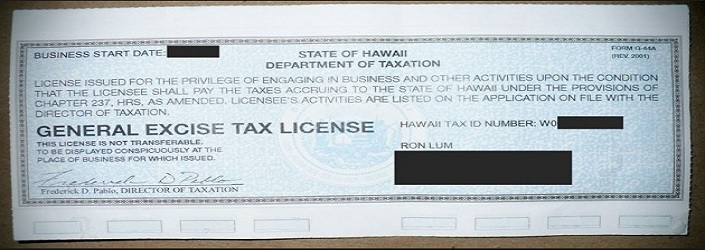

Who issues General Excise Tax License Hawaii?

Department of Taxation, Hawaii issues General Excise Tax Permit to a Hawaii vendor to collect general excise tax from business. The general excise tax application is submitted electronically to the state of Hawaii website.

How to Apply for a General Excise Tax License Hawaii?

It is filed electronically with the State of Hawaii Department of Taxation. State of Hawaii charges $20.00 to issue a general excise tax permit Hawaii. Basic Business Application or Hawaii Business Express online application is filed to get a General Excise Tax.

Who needs General Excise Tax Hawaii?

Every person or a company who offers taxable products and services is needed a General Excise Tax License Hawaii to charge sales tax from a buyer.

How to reinstate General Excise Tax Hawaii?

A new general excise tax license is obtained because the state of Hawaii does not allow reinstatement of a repealed sales tax license.

How to get a duplicate copy of a General Excise Tax License Hawaii?

A duplicate copy of Hawaii GET License is requested by the state of Hawaii and Hawaii state does not ask any fee to issue a duplicate copy of General Excise Tax.

What are the filing frequencies to file General Excise Tax Returns?

General Excise Tax Returns are filed electronically in the State of Hawaii on Department of Taxation website.

Periodic returns due dates which are Monthly, Quarterly and Semiannually are filed by the 20th day of the month following the close of the tax period.

Due date of filing, general excise tax returns is the 20th day of the fourth month following the close of the taxable year, whereas, for calendar year filers due date is April 20th of the following year.

How to calculate general excise tax on taxable items?

The General Excise Tax rate in the state of Hawaii is between 4% to 4.7%, which depends on the municipalities where business is conducted.

General excise tax is applied on taxable goods and services which are published on the Hawaii state website. A sales tax calculator is also used to calculate general excise tax, which is available on the state of Hawaii website.

A partial taxable items list of the state of Hawaii is mentioned below:

-

Wholesaling goods

-

Manufacturing

-

Producing

-

Providing wholesale services

-

Business activities of disabled people

-

Selling retail goods and services

-

Renting

-

Leasing real property

-

Construction contracting, earning commissions

Does state of Hawaii allow an exemption to a Non Resident and an exempt organization such as nonprofit on taxable items?

State of Hawaii does not allow any relief or exemption on taxable items to a Non resident such as tourist, out of state and exempt non-profit organizations. Thus far, the State of Hawaii does not recognize Hawaii GET a sales and use tax, that is why it does not allow an exemption for non-profit entities.

What happens if a vendor of Hawaii does not collect sales tax from a buyer?

Collection of general excise tax is compulsory not an option and a vendor is personally liable to pay the state of Hawaii regardless general excise tax was collected or not from a buyer on taxable items.

What is the penalty and interest on late file general excise tax returns?

State of Hawaii charges penalty between 5% to 25% per month on late filing general excise tax returns. Moreover, the state of Hawaii also applies an interest in addition to the penalty.