Definition of Rhode Island Sale Tax:

Sales tax Rhode Island applies to the certain retail transaction which sells to end consumer. It is not applicable on sale to distribution and sale to the wholesaler from the distributor. Rhode Island levies sales tax on the retail sale, rental or lease of many goods and services at a rate of 7%. The most updated list of the sales tax views on the Rhode Island Division of Taxation website to calculate an accurate sales tax on the taxable goods and services.

What is retail sale?

Every sale in the state of Rhode Island is a retail sale if it doesn't buy for further resale. Sales tax is collected by a seller, which remits directly to the Rhode Island Division of Taxation.

Who bears the burden of sales tax in Rhode Island?

A register seller of Rhode Island act as a withholding agent of the state, it collects sales tax from the domestic or out of state buyers and remit to the Rhode Island Division of Taxation. In fact, sales tax is paid by the buyer for the purchase of retail products.

Definition of Rhode Island Use tax:

Use tax is perceived a sales tax which is charged to a local or out of state buyers whom which sales tax was not collected on the taxable items of the state of Rhode Island.

The use tax Rhode Island is charged to the following customers:

-

Taxable items from the inventory which are taken out for the personal use is subject to use tax.

-

Use tax is collected from an out of state vendor on the items which are subject to sales tax in the state of Rhode Island.

-

Use tax is also collected from a domestic purchaser if sales tax was not paid on the taxable items.

How to pay use tax in the state of Rhode Island?

The following methods are used to pay use tax according to a unique situation:

Items purchased from an out of state vendor: Sales tax is reported on the income tax return end of the year. No reporting is applicable if sales was already paid to the out of state vendor unless it was paid the lesser sales tax amount to the out of state vendor. In this case the difference is paid.

A domestic buyer purchased taxable items without sales tax: It is either reported on the income tax return end of the year or pay directly to the Rhode Island department of taxation.

What services and goods are subject to sale and use tax in Rhode Island?

Any business engaged in selling, renting or leasing tangible personal property at retail, which includes, but is not limited to, the following: home appliances, craft items, household furnishings, antiques, VCR's & tapes, jewelry, stereo & TV equipment, computers and computer software must collect the sales tax.

Some services are also taxable. Taxable services include, but are not limited to the furnishing of telecommunications service and cable television services.

Further, if you operate an eating and/or drinking establishment, you must also collect and remit the 1% local meals and beverage tax.

Non-applicability of Sale tax registration for wholesaler

Wholesalers are not required to obtain sale tax registration. Sales tax is only applicable when all or portions of the sale is at retail.

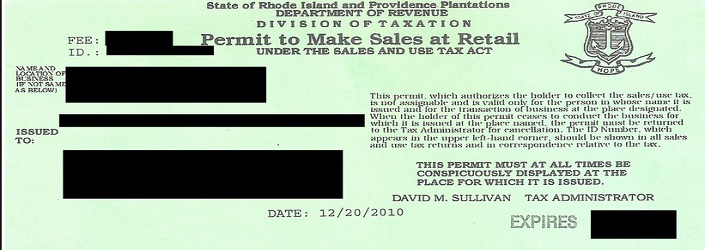

How to obtain sale and Use tax permit in Rhode Island?

An electronic request is filed in the Rhode Island department of taxation website for the sales tax registration to collect sales and use tax on taxable goods and services.

The Rhode Island filing fee is $10.00 to obtain sales and use tax. Rhode Island department of taxation generally issues sales tax certificate in 7-10 working days.

Does a sales tax permit renew in the state of Rhode Island?

RI sales tax permit is renewed every year and state charge $10.00 to issue a valid sales tax certificate.

Sale and use tax permit for an additional business location under the same entity:

A separate application is filed to get a sales tax permit for a new location under an existing entity.

When to file a sale and use tax return with the Rhode Island Department of Taxation?

Sale and use tax returns file on a monthly basis within 20 days of the next month for example, sales tax, return on March 2016 files on or before 20th of April 2016.

What are the penalties for late filing of sale and use tax return Rhode Island?

-

There is a penalty of 10% of the tax due for the late payment of the tax. Sales tax penalties are compulsory whether it was neglected consciously or overseen unconsciously.

-

Interest at the current rate is also calculated on the underpayment of tax, but not less than 12%.

What Records of business transaction must be taken for sale tax purpose?

The following records are kept at least three years, but under certain circumstances which is produced for audit purpose.

-

Sales receipts

-

Filed sales tax returns with an evidence that it was filed on time.

-

Purchase invoices

-

Cash register tapes

-

Exemption certificates

How to file the final sales tax return? In case of winding up / ending your business?

A Sales and Use Tax permit is given back to the Rhode Island Division of Taxation upon closing down the business along with the following documents:

-

File monthly or quarterly return and check the "Yes" box following the question, "Are you out of business now?"

-

Enter the last business date in the block provided.

-

Also, write the word FINAL prominently across the top of the return.

-

Enclose your permit card with the return.

Division of Taxation usually takes estimated two weeks to issue you a sales tax license.

What entities are exempted from the Sale Tax in Rhode Island?

-

A charitable or religious organization provides a Rhode Island Exempt Organization Exemption Certificate in order to buy tax free items.

-

A manufacturer presents a Manufacturers Exemption Certificate in order to buy tax exempt purchases.

-

A farmer presents a copy of the Farmer Tax Exemption Certificate to purchase taxable items without sales tax.

What happens if neither sales and not use tax is paid on taxable items in Rhode Island?

It is an unethical practice to violate fundamental principles such as do not pay taxes on taxable goods and services, if it is levied by the state which ultimately use for the citizens to provide facilities.

Rhode Island Division of Finance seizes all contraband items which are illegally imported from the out of supplier and sales and use taxes was not paid.

For example: If cigarette items were bought from out of state suppliers without state or sales tax which are subject to sales tax in the state of Rhode Island, it will be seized.

Sovereign of UN-stamped cigarette purchaser in the state of Rhode Island through telephone, mail order, online to keep the cost low may be seized by the law enforcement agencies or face imprisonment.