What is the Massachusetts Sales Tax?

The buyer pays the sales tax to the vendor at the time of purchase; the vendor then remits the tax to the Commonwealth.It is collected on the taxable items and services provided in the state of Massachusetts .It is a value added tax and added to the purchase. Sales tax is calculated on the gross receipts.You cannot start a business in MA without completing sales tax application to provide taxable products and services. Sales tax collected from the customer must be paid back to the Massachusetts Department of Revenue.

What is the Massachusetts Use Tax?

Generally paid on out of state purchases, used, stored or consumed products in the Commonwealth. Use tax is usually pay on;

- over the Internet

- from an out-of-state vendor

- from an out-of-country vendor

- from a mail-order catalog.

Difference between Sales and Use Tax?

- The seller collects sales tax from the buyers on taxable items and services and directly pay to the MA Department of Revenue. Seller also considered an agent, works between a buyer and department of revenue.

- Use tax is directly paid by the buyer to the Commonwealth.

- The use tax, implementation is also important for the State of MA sellers to encourage purchasers to buy locally instead of avoiding paying sales tax to the MA state, because it is very unfair to the local sellers and department of revenue.

Who is a sales/use tax vendor?

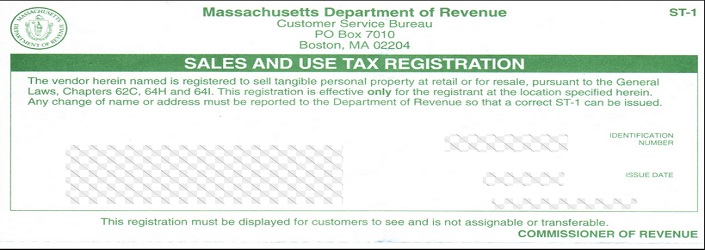

A sales/use tax vendor is a retailer or any other person who regularly sells, rents or leases tangible personal property or telecommunications services that are subject to the Massachusetts sales tax. If you plan to sell tangible personal property items, meals; or certain telecommunications services; you must register with Department of Revenue as a sales tax vendor.

Tips to apply for Massachusetts Sales Tax Number:

You can file an application electronically with the Massachessets Department of Revenue to get a sales and use tax number. State of MA usually, issues Massachusetts sales tax license instantly after completing the application online.

MA Sales and Use Tax Reporting Deadlines

- If annual sales and use tax collected $100 or less-Pay Annually due 20 days after the end of the filing period.

- If annual sales and use tax collected From $101 up to $1,200-Pay Quarterly due 20 days after the end of the filing period.

- If annual sales and use tax collected $1,201 or more-Pay Monthly due 20 days after the end of the filing period.

Obligations of Sales and Use Tax Permit Holder

- Obtain sales and use tax certificate fro DOR before collecting sales and use tax from customers on taxable merchandise and services.

- Report sales and use tax to the DOR on time to avoid paying interest and penalties.

- Make payment to MA DOR on time, you have collected from your customers as a sales and use tax.

- MA Sales and Use tax certificate is not transferable and you cannot transfer it to the new owner, if selling the business.

- You have to surrender sales tax license to MA DOR, if closing out business.

- You have to keep proper books and records to share with the MA DOR, in case of audit or review your books and records.