Definition of Georgia Sales and Use Tax?

Georgia sales and use tax are taxed on taxable tangible properties and services which are listed on the Georgia Department of Revenue website.

Use tax is imposed on the non-exempt items which are brought into the state of Georgia without paying a sales tax or in a personal use.

Sales and use tax is computed on the gross receipts, including any handling charges.

Every individual or a legal entity who is conducting business in Georgia and meets the definition of a "Dealer" is required to obtain a sales and use tax license, regardless selling online, out of state, wholesale, or exempt from tax.

How to apply Georgia Sales and Use Tax?

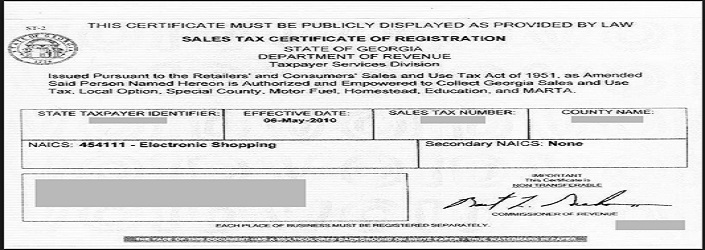

A Georgia Sales and Use Tax license are applied online at the Georgia Department of Revenue website (Georgia Tax Center). Sales tax permit Georgia is printed soon after submitting a sales tax, registration form electronically unless there is a deficiency in the application form and state of GA needs additional information to process sales tax applies.

You have to provide adjusted gross income of last year, if registering sales tax number under sole proprietorship.

Following information is required to file sales and use tax license Georgia:

Name of the business, including an employer identification number if available (it is not required for a sole proprietorship business entity, all business owners names including social security number (if available, it is not required for a non US resident), date of birth, business description and the gross income of prior year which is extracted from form 1040 filed with the Internal Revenue Service (It is not required for the business entities which are registered with the Secretary of State Georgia such as corporations and limited liability companies).

What is the liability of a sales tax vendor?

A vendor of the taxable items is obligated to collect sales and use tax from buyers and deposit to the Georgia department of revenue regardless it was collected from a buyer or not.

Out of Vendor Register for Sales and Use Tax in Georgia:

All out of state vendors exceeding sales of $100,000.00 in the state of Georgia are required to register for sales and use tax license regardless of a nexus in the state of Georgia.

Out of State Vendors participating in Georgia Trade Shows:

Out of state sellers participate in Georgia trade shows are required to follow the same protocol to collect sales and use tax on taxable items and services same as Georgia resident retailers do.

How to Handle Drop Shipping and Exempt Purchases?

A drop shipper collects sales tax on taxable items from the buyer if shipping and delivery are in the same state where as a buyer provides reseller number to qualify for exempt taxable purchases.

Obligations of Georgia Sales and Use Tax Certificate holder:

File sales tax returns on time electronically no later than the 20th day of the month following the period being reported.

Georgia Sales and Use Tax Certificate must be posted prominently on business location.

Sales tax certificates must be canceled and return to the Georgia Department of Revenue, if closing business.

Georgia estimated prepaid taxes:

If sales and use tax liability of a fund holder in the preceding calendar year is greater than $60,000 excluding local sales taxes, the dealer must pay prepaid estimated tax.

The amount of “prepaid” tax that must be remitted is 50% of the estimated tax. “Estimated tax liability” means a dealer's average monthly state tax payment for last calendar year, adjusted to account for any subsequent change in the state sales and use tax rate.